iowa inheritance tax return schedules

The tax return is due nine months from the date of death unless the state Department of Revenue grants an extension. It is one of 38 states in the country that does not levy a tax on estates.

Iowa Estate Tax Everything You Need To Know Smartasset

Here are all the most relevant results for your search about Iowa Inheritance Tax Rate Schedule.

. It has an inheritance tax with a. Register for a. Mortgage Calculator Rent vs Buy.

File a W-2 or 1099. There is a federal estate tax that may apply. This included 143 million in claims stopped by our fraud review.

When Iowa schedules are filed with the return only those schedules that apply to the particular assets and liabilities of the estate are required. Property passing to parents grandparents great-grandparents and other lineal ascendants is exempt from inheritance tax. The inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent.

Deaths in 2021 will be taxed 20 less than the original Iowa Inheritance tax rates. Ad Instant Download and Complete your Amendments Forms Start Now. Find the Instructions For Iowa 706 Schedule K Form you want.

See IA 706 instructions. 1 PDF editor e-sign platform data collection form builder solution in a single app. Inheritance tax rates range from 5 to 10 for sisters brothers half-sisters half-brothers daughters-in-law and sons-in-law of the decedent.

Change or Cancel a Permit. Customize the template with unique fillable fields. The estate tax is only paid on assets greater than 53 million per individual 106 million per couple.

Beneficiaries who are descendants including children biological and legally adopted stepchildren grandchildren and great-grand-children. Schedule B Beneficiaries. 2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows.

Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. Even if an extension is granted on the return the tax payment is still due nine months after death. To pay inheritance and estate tax in the state of Iowa file a form IA 706.

The vast majority of estates 999 do not pay federal estate taxes. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. Property passing to children biological and legally-adopted children stepchildren grandchildren great-grandchildren and other lineal descendants is exempt from inheritance tax.

Track or File Rent Reimbursement. Tax returns are reviewed for accuracy to ensure refunds go to the right taxpayer in the correct amount and stay out of the hands of criminals. Register for a Permit.

Even if no tax is due a return may still be required to be filed. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. All Major Categories Covered.

In 2021 the Department identified 262 million in fraudulent or erroneous refund claims. Iowa InheritanceEstate Tax Return IA 706. Iowa Inheritance Tax Schedule J 60-084.

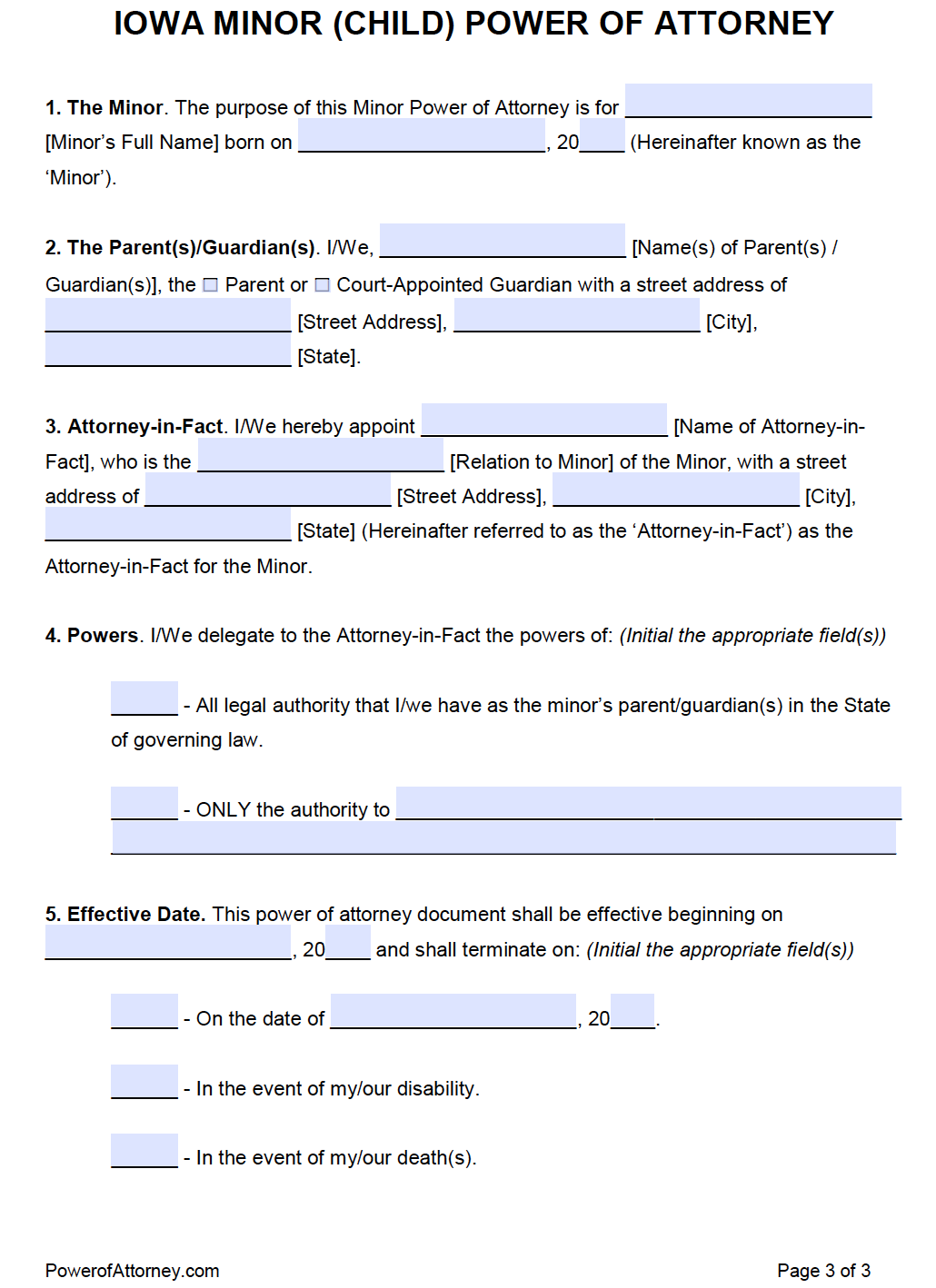

If youre an executor faced with preparing an inheritance tax return you can get. Department forms must be used for the Iowa inheritance tax return and Schedules J and K. Iowa Schedules A through I may be replaced with the IowaState Bar Association probate schedules.

While the top estate tax rate is 40 the average tax rate paid is just 17. Learn About Sales Use Tax. For instance Iowas inheritance tax does not apply if the estate is valued at 25000 or less.

Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by January 1st 2025 between now and then the Iowa Inheritance Tax will reduce by 20 per calendar year starting for deaths that occur in 2021. The Departments inheritance tax return and the liabilities Schedules J and K will be accepted. Enter the decedents name date of death age at the time their address at the time of death and federal identification and Social Security numbers.

The return is due 9 months from the death of the decedent. Once the return is received the Iowa Department of Revenue will issue an inheritance tax clearance which terminates the automatic inheritance tax lien on the property in the estate. Inheritance tax can be complicated.

If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return. The following among others are exempt from Iowas inheritance tax. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return.

If the federal estate tax return includes the schedules of assets and liabilities the taxpayer may omit Iowa Schedules A through I from the return. Iowa InheritanceEstate Tax Return IA 706 Step 1. Learn About Property Tax.

All tax which has not been paid on or before the last day of the ninth month following the death of the individual whose death is the event imposing the inheritance tax draws interest at the rate prescribed by Iowa Code section 4217 to be computed on a monthly basis with each fraction of a month counted as a full month. Bad news for Cyber criminals. This document is found on the website of the government of Iowa.

If the federal estate tax return includes the schedules of assets and liabilities the taxpayer may omit Iowa Schedules A through I from the return. Involved parties names places of residence and numbers etc. Fill in the empty fields.

Open it up with cloud-based editor and begin altering. Learn more at the Iowa Department of Revenue. A return merely listing the assets and their values is not sufficient in estates that exceed 10000.

An extension of time to file the return and make payment may be requested by contacting the Department. An extension of time to file the return and make payment may be requested from the Iowa Department of Revenue but interest is charged on unpaid taxes which remain due accruing on a monthly basis. Spouses children and parents of a deceased person are exempt from Iowa inheritance tax while other inheritors might have to pay.

How much is the inheritance tax in Iowa. Certain cases of decedents dying on or after July 1 2004. Iowa Inheritance Tax Rates.

If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero. There are also several situations that do not require an Iowa inheritance tax return to be filed. Add the particular date and place your e-signature.

There is no estate tax in Iowa. I had no issues with with the Federal tax return or the Illinois tax return with. Track or File Rent Reimbursement.

Stay informed subscribe to receive updates. Select Popular Legal Forms Packages of Any Category. The Schedule K-1 itself is not filed by you but is an integral part of the Form 1041 filing.

Iowa Or Ia State 2021 Income Taxes Can Be Filed With Irs Return

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Free Maryland 14 Day Notice To Quit Threat To Others Pdf Word Template Eviction Notice Quites Lettering

Asset Protection For Cash How To Protect Any Currency Infographic Http Www Assetprotectionpackage Com Asset Offshore Bank Protection Building An Empire

Free Iowa 3 Day Notice Of Termination And Notice To Quit Pdf Word Template Eviction Notice Word Template Quites

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Free Iowa Power Of Attorney Forms Pdf Templates

Iowa Estate Tax Everything You Need To Know Smartasset

Your Bank Account Deserves A Boost Cheat Sheets Money Saving Tips Money Saving Challenge

Iowa Estate Tax Everything You Need To Know Smartasset

Statement Of Cash Flows Corporation Indirect Method Business Forms Accountingcoach Cash Flow Statement Cash Flow Flow

Printable Vehicle Bill Of Sale Check More At Https Nationalgriefawarenessday Com 10546 Printable Vehicle Bill Of Sale Bill Of Sale Template Bills Templates